- Tax e file extension 2016 irs for free#

- Tax e file extension 2016 irs how to#

- Tax e file extension 2016 irs verification#

Your payment counts as a state extension with most states.

Tax e file extension 2016 irs how to#

Tax e file extension 2016 irs for free#

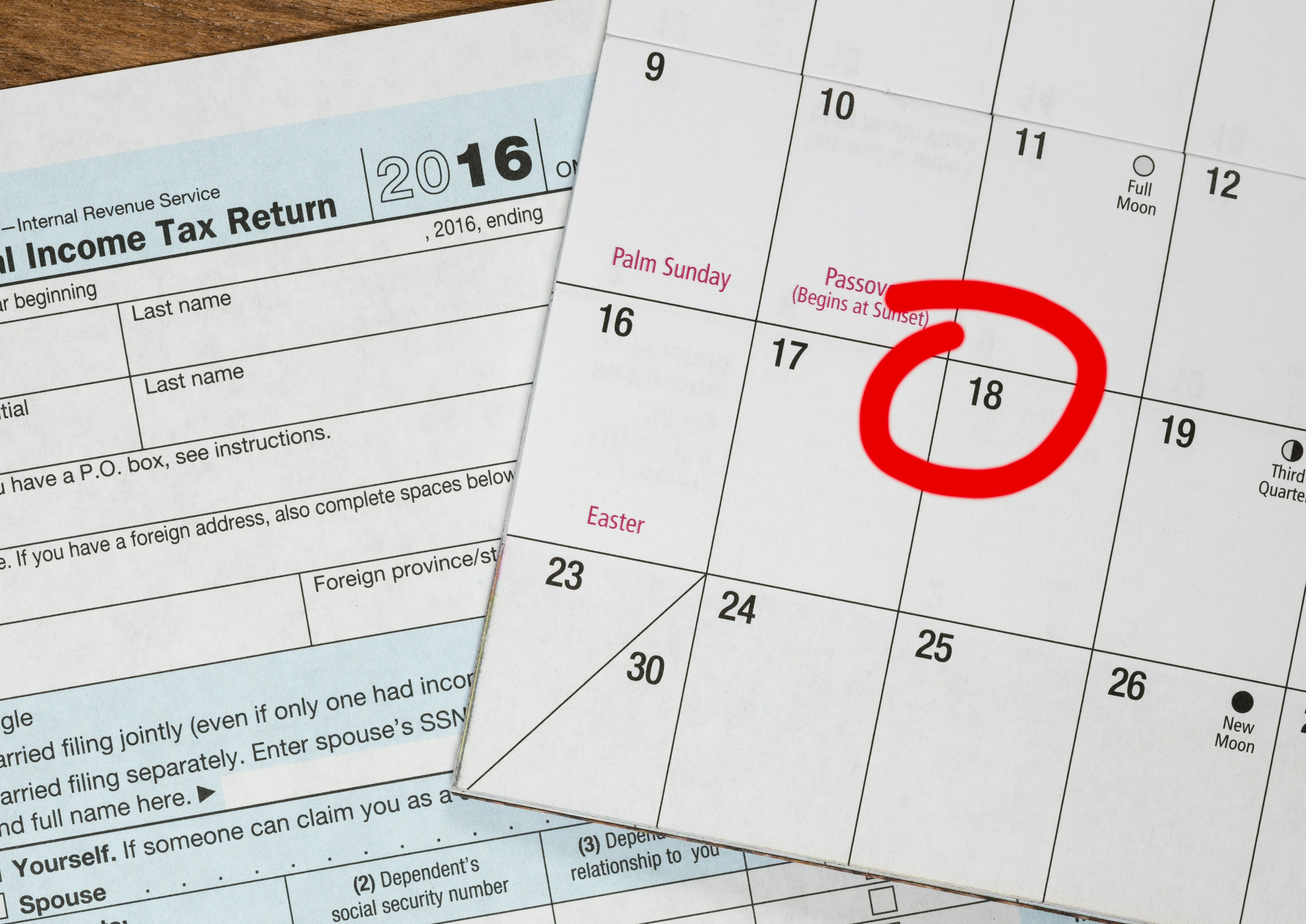

You can e-File Form 4868 or Form 2350 for free on. Learn below if you should even eFile an extension or not if you are owed a tax refund, then according to the IRS, a tax extension is not necessary. IRS Tax Extensions can be e-Filed for free on now through April 18, 2022. Follow these instructions on how to e-File a tax return after you have filed a Tax Extension.Simple pay some or all your state taxes via this link. Thus, you would not have to file an extension form in that case. For other states paying your taxes owed serves as a state tax extension. Some states give automatic tax extensions based on the IRS extension. Details and Instructions about State Tax Extensions.Instructions on how to eFile an IRS Tax Extension for free and/or pay IRS taxes.If you filed prior to the deadline, but were rejected, you will likely have until April 22 to mail in your extension. Payment and mailing instructions are on pages 3 and 4 of your printout. Download and print Form 4868, fill it out, and get it postmarked before 11:59 p.m.Recommended: Pay your taxes at IRS Direct Pay (this also automatically gives you an extension).If you don't have your AGI, or your extension gets rejected for the wrong AGI, here are 2 options:

Tax e file extension 2016 irs verification#

Note: If you're paying additional taxes owed with direct debit, you'll need to provide your 2020 AGI for verification purposes (if you didn't file a 2020 return, enter 0 as your AGI).

Select File an extension at the bottom of the column on the left side of the screen.(To do this, sign in to TurboTax and select Pick up where you left off).

(You'll still owe interest if you pay after the deadline). Keep in mind: An extension doesn't give you extra time to pay your taxes - but it will keep you from getting a late filing penalty. It isn't possible to file a post-deadline extension.

IRS extensions for tax year 2021 must be filed on or before April 18, 2022 for domestic taxpayers.

0 kommentar(er)

0 kommentar(er)